Rohit Sipahimalani, chief investment officer of Temasek International, pointed out that Temasek will continue to actively invest in major markets while exploring new markets with economies of scale to enhance the resilience of the investment portfol...

Rohit Sipahimalani, chief investment officer of Temasek International, pointed out that Temasek will continue to actively invest in major markets while exploring new markets with economies of scale to enhance the resilience of the investment portfolio.

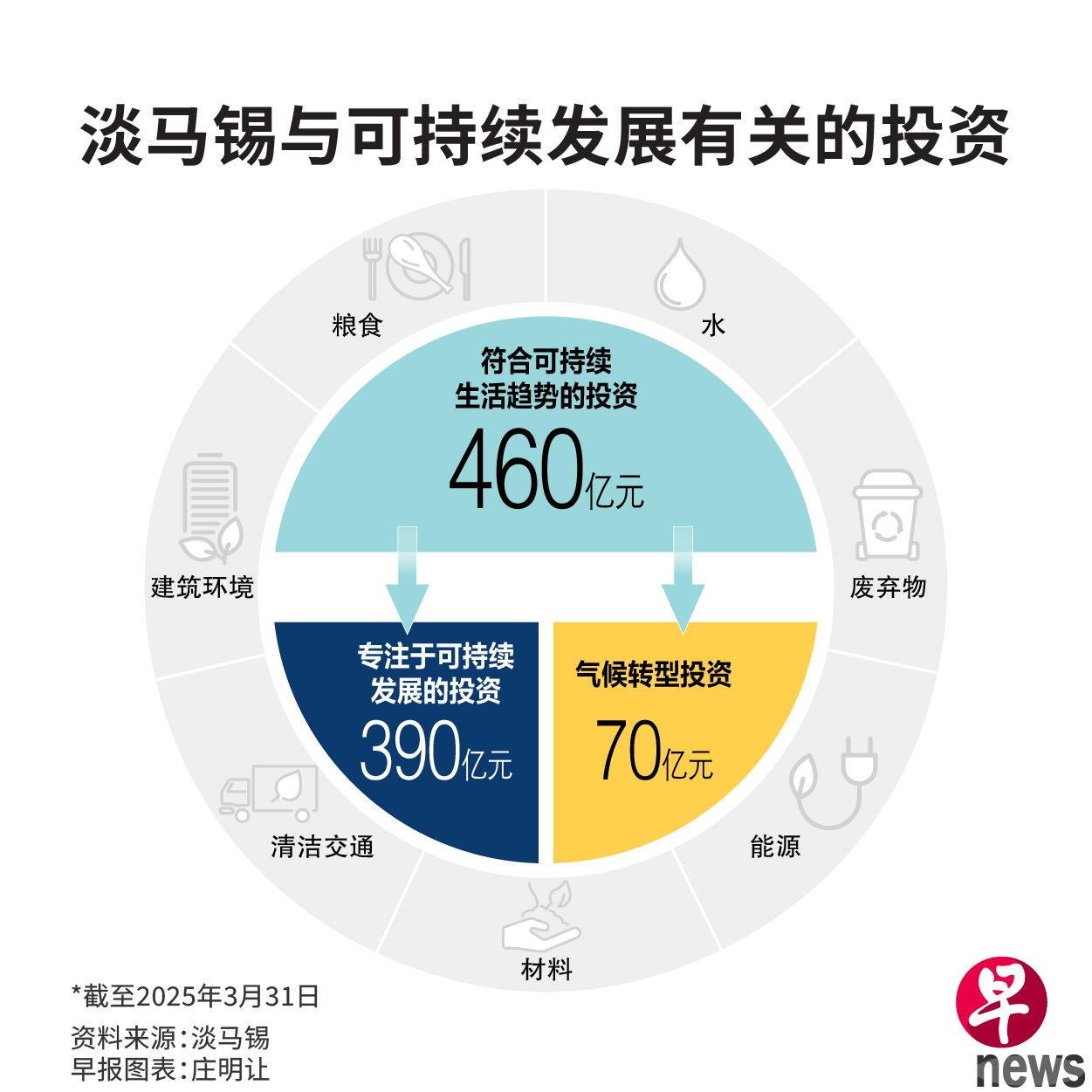

Billion yuan of the portfolio is invested in companies focusing on sustainable development, and their products and services actively help Temasek achieve a long-term vision of net zero emissions, nature positive and inclusive growth, such as Swedish clean energy technology company Aira, renewable energy development company Neoen, and US company Zipline, which provides logistics services for healthcare and agriculture.

The remaining 7 billion yuan is used for climate transformation investment, mainly investing in enterprises with high carbon emissions but are transforming. These companies are developing products and services that are positively contributing to climate goals, such as Sembcorp Industries, UK-based sustainable infrastructure company Atlantica and Danish company Topsoe, which supplies emission reduction technologies.

In the past few years, Temasek has also focused its investments on nuclear, geothermal, natural gas and carbon markets.

As of the end of March this year, Temasek's investment in sustainable development-related fields reached 46 billion yuan, with a total investment portfolio of 2 billion yuan or 4.5% more than last year.

Temasek released its 2025 Sustainability Report on Wednesday (July 9) pointed out that 46 billion yuan is invested in companies that meet the trend of sustainable living. Investment is distributed in seven major areas, including food, water, waste, energy, materials, clean transportation and built environment.

Given that current geopolitical downsides may increase carbon emission reduction costs, authorities will remain flexible and adjust their investment methods if necessary. Temasek continues to commit to reducing the combined net carbon emissions of its portfolio to half of its 2010 emission levels by 2030.

In fiscal year 2025, the Temasek portfolio's carbon emissions were 21 million metric tons of carbon dioxide equivalent (tCO2e), the same as the previous fiscal year. Temasek looks to reduce portfolio emissions to 11 million metric tons by 2030.